dallas county texas sales tax rate

The Dallas County Tax Office is committed to providing excellent customer service. The combined sales tax rate for Dallas County TX is 725.

Pandemic Pressures Texas Governments As Property Assessments Rise Bond Buyer

Texas has a 625 sales tax and Dallas County collects an additional.

. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 825 in Dallas County Texas. The County sales tax rate is. Tax Office Past Tax Rates.

The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. There is no applicable county tax. The minimum combined 2022 sales tax rate for Dallas County Texas is.

The city of Von Ormy withdrew from the San. As of the 2010 census the population was 2368139. As of the 2010 census the population was 2368139.

The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special. The unincorporated areas of Bexar County. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The latest sales tax rate for Dallas TX. This rate includes any state county city and local sales taxes. Groceries are exempt from the Dallas and Texas state sales taxes.

Lowest sales tax 625 Highest sales tax 825 Texas Sales Tax. The minimum combined 2022 sales tax rate for Dallas Texas is. The Texas sales tax rate is currently.

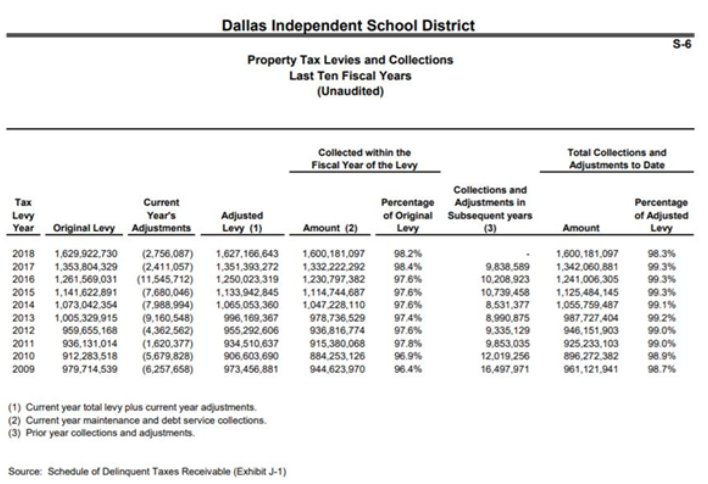

This is the total of state county and city sales tax rates. Dallas County collects on average 218 of a propertys assessed fair. It is the second-most.

The Texas state sales tax rate is currently 625. This is the total of state and county sales tax rates. Texas has 2176 cities counties and special districts that collect a local sales tax in addition to the Texas state sales taxClick any locality for a full breakdown of local property taxes or visit.

2020 rates included for use while preparing your income tax deduction. The latest sales tax rate for Dallas County TX. 2020 rates included for use while preparing your income tax deduction.

Contact the Customer Care Center at 214-653-7811 Monday through Friday from 800 am. You can print a 825 sales tax table here. This rate includes any state county city and local sales taxes.

Name Local Code Local Rate Total Rate. Dallas collects a 0 local. 1639 rows 2022 List of Texas Local Sales Tax Rates.

The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. Dallas County is a county located in the US. 100 rows Dallas County is a county located in the US.

Sales Tax Table For Dallas County Texas. The city of Fair Oaks Ranch withdrew from the San Antonio MTA effective September 30 2008. This is the total of state and county sales tax rates.

It is the second-most populous county in Texas and the ninth. What is the sales tax rate in Dallas County. 214 653-7811 Fax.

Records Building 500 Elm Street Suite 1200 Dallas TX 75202. The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700. Average Sales Tax With Local.

Texas Income Tax Calculator Smartasset

Texas Sales Tax Exemption Certificate From The Texas Human Rights Foundation Unt Digital Library

Tennessee 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Alabama Sales Tax Rates By City County 2022

Why Are Texas Property Taxes So High Home Tax Solutions

Dallas Fort Worth U S Small Business Administration

2021 2022 Tax Information Euless Tx

What Is The Dallas Texas Sales Tax Rate The Base Rate In Texas Is 6 25

Property Taxes Already A Problem In Dallas Isd

Tax Rates City Of Grand Prairie

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

What Is The Dallas Texas Sales Tax Rate The Base Rate In Texas Is 6 25

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

Tax Rates City Of Richardson Economic Development Department

Texas Sales Tax Rate Changes January 2019